News

Why you need to consider Whole-Life Costs

Ignoring the total cost of ownership could mean you're spending more than you need to. Here's what you need to consider when choosing your next company car or fleet.

When choosing a new company car or refreshing your fleet, cost is a key factor. But it's not as simple as looking at the purchase price of the vehicle. After purchase, every vehicle costs a different amount to run, and over the period of ownership, that can have a large effect on the amount you spend. So, if you want to get the best value for money, you have to consider the whole-life cost (sometimes called total cost of ownership or TCO) of the vehicle.

Today, it is more important than ever to consider the whole-life costs of your vehicles, so read below to find out the key areas you need to consider - or if you're already well-versed with whole-life costs, you can read on to see what Kia is doing to help you or your business save money.

To make sure that Kia always offers attractive whole-life costs, we use an independent software called kwikcarcost, to continually compare against other manufacturers and ensure our cars are competitive.

The initial price of a vehicle may be significantly less important than you think.

This is the obvious starting point, but by no means the most important cost. The P11D value of a car is the list price including VAT and delivery charges but it does not include the first registration fee or VED. While the price of the car is certainly important, it shouldn't be your sole focus. A car may have a more expensive list price than a competitor, but it may also be significantly cheaper to run, and therefore, less expensive over the period of ownership.

Still, it's worth trying to get the best deal you can regardless of which car you choose! Speak to the Kia Business Centre, and our dedicated team of experts can assign you a one-to-one account manager who will take the time to find you the best deal possible on your new car.

Your car's value will change during ownership. This is a large part of whole-life costing.

Let's assume you run your car or fleet for three years before updating to a newer model. During that time, the value of the car will decrease. The less it decreases, the less your car will cost over the period of ownership - either because you can sell it for a higher price, or because the provider of the car will charge lower monthly fees depending on how you finance the car. Simple.

Kia takes several steps to ensure residual values are high, so that it can offer favourable monthly rates and reduce your whole-life costs. For example, with Kia's famous seven-year warranty, a three-year-old used car can still be sold with four years warranty remaining, which helps our cars hold their value.

Furthermore, when Kia has the opportunity to provide a large volume of cars, they look in detail at how that could affect each model's resale value, and will even turn down large sales opportunities in order to protect the resale value of your cars.

Tax can be complicated, but it can't be ignored.

There are many parts to taxation, and that can make it seem complicated. Helpfully, it's mostly pegged to the CO2

emissions of a vehicle, but there are other variables. It's also worth considering that there are potentially massive savings here with electric and hybrid cars.

Vehicle Excise Duty is a simple place to start. This is judged on a vehicle's CO2

emissions, and also its electric range if appropriate. Electric vehicles - such as the Soul EV and e-Niro - are exempt from VED.

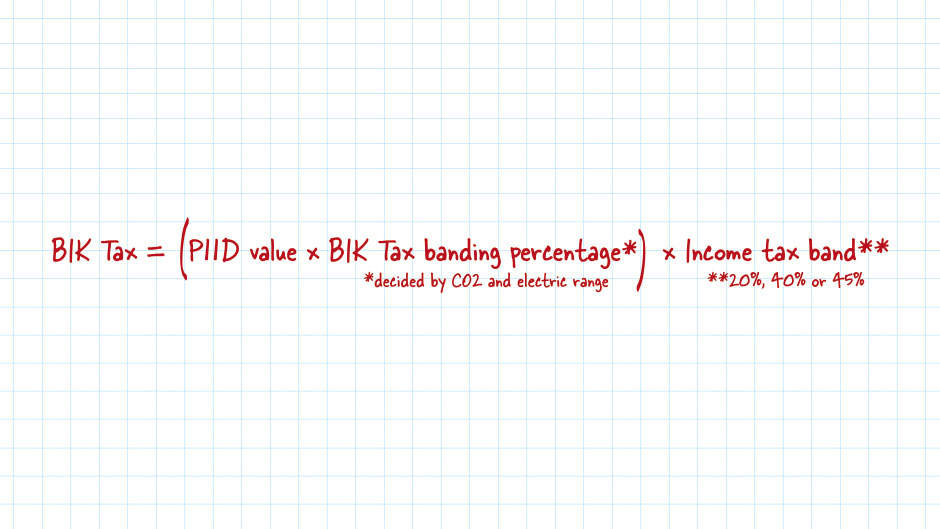

Benefit-in-Kind tax has potentially larger implications. Here's how its calculated:

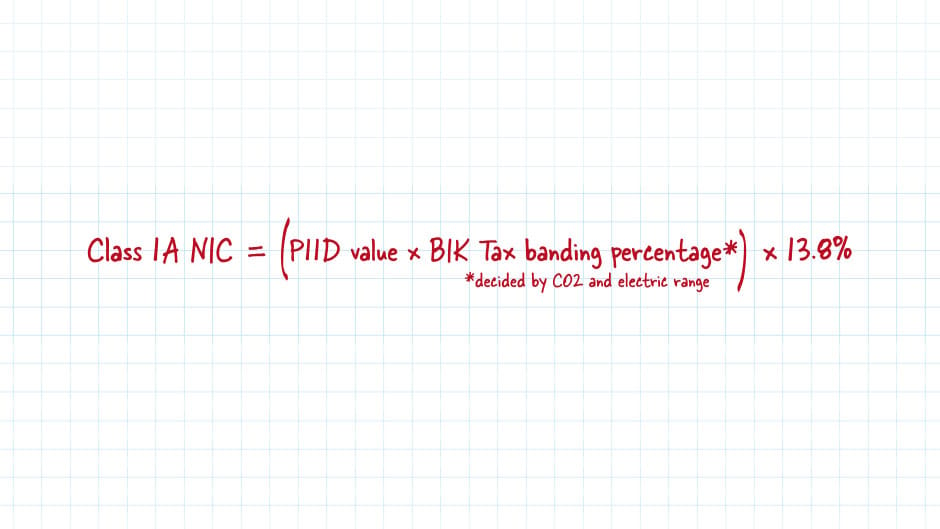

Employers' Class 1A National Insurance Contributions are calculated in a similar way:

Because of the different variables involved, BIK tax and classes 1A NIC can vary greatly. For example, electric vehicles will pay zero BIK tax in 2020/2021, so there is an enormous savings potential here - as much as several thousands of pounds over three years in some cases.

Capital allowances also need to be considered. You can deduct some of the cost of the vehicle for your business from the profits before tax. The amount you can deduct is again based on CO2

emissions. A fully electric car - such as e-Niro or Soul EV - is entitled to be fully deducted. In fact, all hybrid models - hybrid, mild-hybrid and plug-in hybrid - will enjoy favourable tax rates because of their low CO2

emissions.

So, while electric vehicles tend to have a higher P11D price, there are huge tax savings to be made - further evidence that whole-life costs are essential. Why not check out Kia's Eco range to see how they're helping your business save on tax?

Whether you're a company car driver or running a fleet, fuel can be a considerable cost over the course of ownership.

Fuel efficiency needs consideration. Depending on the average mileage of you or your drivers, this can make up a substantial part of the total cost of ownership.

If you buy the cheaper of two cars, but it uses significantly more fuel, you're unlikely to have saved money over the life of the vehicle. For example, if car A costs £1,000 less than car B, but costs £30 more per month to fuel, car A would actually work out more expensive over three years of ownership.

To help keep fuel costs down, Kia is continually introducing new technologies to its advanced range of powertrains. They are also continuing to add models to their award-winning Eco range, with a choice of mild hybrid, hybrid, plug-in hybrid and electric vehicles that can drastically reduce your fuel cost.

A lower insurance group, means less insurance expense

Having a car that depreciates slowly is of little value if the savings are offset by higher insurance costs. There are many factors that affect insurance, including: value, repair costs, parts prices, performance, safety and more.

To help keep insurance costs low, Kia offers an incredible suite of safety features with its cars. Depending on the model, you can expect features such as Blind-Spot Collision Warning, Rear Cross-Traffic Collision Warning and Forward Collision-Avoidance Assist, which all help to reduce the likelihood of an accident, and allow Kia cars to align with a more favourable insurance group.

To maintain their value, and ensure they're safe, cars will incur service, maintenance and repair costs over their life.

Hopefully repairs won't be a regular problem, but servicing and maintenance are a necessity, and their costs cannot be ignored. The cost of parts and labour can vary drastically between manufacturers and even between individual dealers. Thankfully, Kia's industry-leading, seven-year, 100,000-mile warranty offers some peace of mind here.

Kia has taken steps to make sure that it is particularly competitive in this area. Business users can expect to receive the same excellent level of service regardless of which region they're in. Kia also sets maximum response times and lead times, to ensure you get a fast, exemplary service.

Then there's the Kia Care servicing packages, which can offer you fantastic value for servicing and MOTs.

If your interested in finding out how much you could save, why not give the Kia Business Centre a call?

Contact the Kia Business Centre