Electric Car Tax Benefits Explained

Benefit In Kind (BIK) Tax on Electric Cars

Benefit in Kind (BIK) tax, widely known as company car tax, is calculated by the value of the vehicle, its CO2 emissions and the employee's income tax band. Electric cars are a taxable benefit, which means employees have to pay Benefit in Kind (BIK) tax on electric company cars.

However, electric cars currently benefit from a much lower BIK rate than petrol, diesel or hybrid cars.

In April 2020, the BIK rate for fully electric cars was reduced to 0% for the tax year 2020-2021, and then increased to 1% for 2021-2022 and 2% for 2022-2023. The 2% Benefit in Kind rate has now been frozen until 2025, so electric company cars

drivers can continue to enjoy reduced BIK rates until this date.

Tax Benefits of Electric Cars: A Complete Guide

In November 2022, the UK government announced that as of April 2025, electric cars will be subject to vehicle excise duty (VED). Despite this eventual change, electric cars

are still being recognised as the future of sustainable driving. Right now, there are still multiple electric car tax benefits available to EV drivers that we’d like to share with you.

We know that switching to electric is rewarding. One of the key advantages to switching to an EV is the tax benefits, especially as we face this cost-of-living crisis. In this article, we’ll explore the various tax benefits available to electric car drivers, both individuals and companies, and how you can capitalise on them while they last.

.jpg)

Types of Electric Car Tax Exemptions

Most drivers are familiar with the numerous car taxes levied upon drivers. Many of these car taxes are implemented by the government to encourage the use of lower-emission vehicles or public transport and reduce our individual emissions.

As fully electric cars are built upon the philosophy of sustainable, emission-free driving, EV drivers can enjoy exemptions from the following car taxes and charges. Unfortunately, most of the electric car tax benefits are not also applicable to hybrid cars, which are not emission-free.

Do Electric Cars Pay Road Tax?

Road tax

is an annual car tax imposed by the government. Formally known as Vehicle Excise Duty (VED), road tax is calculated by your car’s price and how much CO2 it emits.

Do electric cars pay road tax?

There is currently no road tax on electric cars, which is one of the biggest tax benefits of being an EV owner. As of April 2025, when they will be taxed the same as petrol, diesel and hybrid cars.

Drivers who buy an electric car

now, such as the Kia Niro EV

and Kia EV6,

can still enjoy this VED exemption until then.

Since April 2020, electric cars have also been exempt from the road tax

surcharge that is applicable to cars over £40,000 and registered after 1st April 2017.

.jpg)

Congestion Charge

Electric cars

are also exempt from congestion charges, a payment enforced for cars when entering a Clean-Air Zone (CAZ). These are currently in place in London, Birmingham and Oxford, with more planned across other UK cities.

This is a huge advantage when it comes to congestion tax for company electric cars,

as they can travel within central London and other city centres without being charged. In London, the EV congestion charge exemption will end in 2025, meaning now is the best time to switch to electric and make the most of this benefit. Read more about why electric cars are exempt from congestion charges.

Considering the move from petrol or diesel? Learn more about hybrid and electric vehicles

Making the switch to electric? Read about the reduced cost of electric cars

Capital Allowance

Businesses using company electric cars

are also entitled to 100% first-year capital allowances, meaning you can deduct the entire expenditure for your car from your profits before tax. This could provide huge amounts of tax relief in the first year, making EVs an ideal option as company cars.

In April 2021, this regulation changed so that only fully electric cars are now eligible for the 100% capital allowance, meaning this is no longer also a tax benefit of hybrid cars

. This regulation shift demonstrates the increasing recognition of pure EVs as the future of driving.

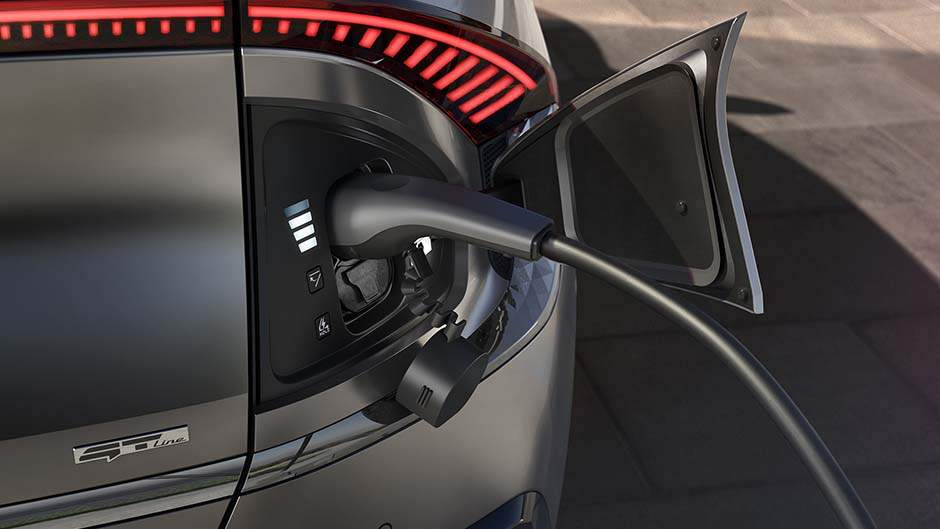

EV charging

When it comes to EV charging

, there is a saving to be made for companies using electric cars.

Firstly, company electric car tax does not include fuel duty, as it normally would for petrol or diesel cars, because electricity isn’t classed as fuel.

For individuals, EVs also bring the benefit of cheaper running costs compared to petrol or diesel models. The improved economy of electric cars, along with the various other EV tax benefits, makes electric cars a more economical long-term choice.

.jpg)

Workplace EV charging

If you’re an employer, you may be able to benefit from an electric car Benefit-in-Kind tax exemption by installing EV chargers at your workplace.

To qualify for workplace EV charging tax exemption, businesses must meet the following criteria:

- Have at least one charger dedicated to the workplace

- Ensure the charging point(s) are located at or near the office

- Make the charging point(s) available to all employees (or all employees at a specific location)

It’s Time to Go Electric

Right now, there are numerous electric car tax benefits available for private drivers and companies. for private and company car drivers. If you want to invest in sustainable, zero-emission driving without the hefty price tag of numerous car taxes, explore our exciting range of fully electric cars, including the new Kia EV9

or the Kia EV6.

Step into the future with Kia.

Images shown are for illustration purposes only and may not be to full UK specification. Features shown are not standard across the Kia model range and availability will vary dependant on model. For further details please refer to the individual model specification sheets.

*Fuel economy and emissions: driving range standards are calculated using the World Harmonised Light Vehicle Test Procedure (WLTP).

**There are certain situations in which the petrol engine will automatically activate even when the vehicle is in EV mode. Examples could include: when the hybrid battery state of charge is reduced to a certain level, when acceleration demand is high and/or when it is required to heat up the cabin.

*** Forward Collision-Avoidance Assist (FCA)

Forward Collision-Avoidance Assist (FCA) is an assistance system and does not relieve the driver from their responsibility to safely operate the vehicle at any time. The driver still has to adapt their driving behaviour to their personal driving capabilities, to the legal requirements and to the overall road and traffic conditions. FCA is not designed to drive the vehicle autonomously. For further information, please refer to the owner’s manual.